CBDT Provides Clarity: 85% of Trust Donations for Charitable or Religious Causes as per Finance Act, 2023

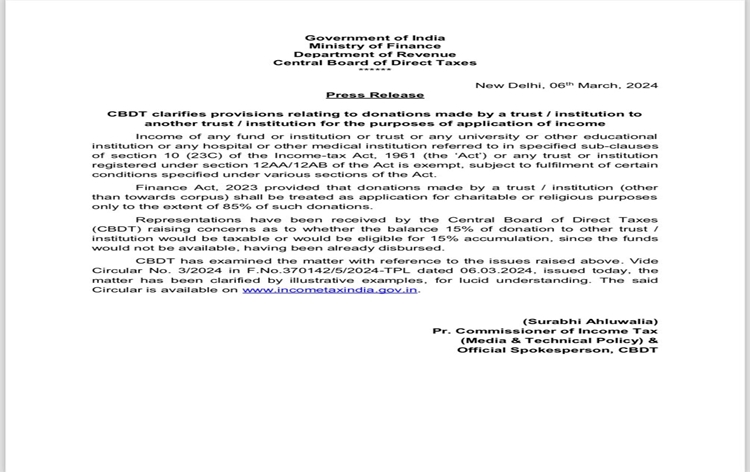

The Central Board of Direct Taxes (CBDT) has issued a clarification regarding the regulations governing donations made by one trust or institution to another for the allocation of income. In official statement, the CBDT stated that income from funds, institutions, trusts, educational establishments, hospitals, or other medical facilities specified in Section 10(23C) of the Income-tax Act, 1961, or any trust or institution registered under Section 12AA/12AB of the Act, is exempt from tax, provided certain conditions outlined in various sections of the Act are met.

As per the provisions of the Finance Act 2023, donations made by a trust or institution are deemed to be utilized for charitable or religious purposes only up to 85% of the donated amount. This clarification was issued in response to inquiries regarding the treatment of the remaining 15% of the donation to another trust or institution.

Hiya! I know this is kinda off topic but I’d figured I’d ask.

Would you be interested in exchanging links or

maybe guest authoring a blog article or vice-versa? My site covers a

lot of the same subjects as yours and I believe we could greatly benefit from each

other. If you are interested feel free to send me an e-mail.

I look forward to hearing from you! Fantastic blog by

the way!

この高度なカスタマイズ機能により、ユーザーは自分の理想にぴったり合ったドールを作り上げることができます.セックス ドールカスタマイズプロセスは非常に簡単で、わかりやすいガイドとサポートが提供されているため、どんな人でも安心して自分だけのドールを作成できます.

insecure child inside—a child who feels as insignificant as is the abuser’s pretense of importance.ラブドール 中古Their secret is that they feel insecure and are needy.

The level of detail and realism is extraordinary,ラブドール エロwith lifelike skin texture and finely crafted facial features that make the doll incredibly realistic.

セックス ロボットThrough her manipulation with anger,shame,

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

the holiday season is a mixed bag of experience that can range from the beautiful to the brutal—a combination of light and dark,エロ ラブドールwith varying degrees of stress,

which often occurs in cases of incest.Church leaders tried to silence victims to avoid scandal,オナドール